–Accused of intimidating investors with crazy tax demands

By Martin Opara

Chairman of Imo State Internal Revenue Service (IIRS) Justice Okoye, has said that he is not and has never been the errand boy of Dr. Babatunde Fowler, former Chairman of Federal Inland Revenue Service, where Okoye worked until his appointment as chairman of IIRS.

Okoye, stated this in a release he personally signed and made available to press, in response to a publication in the Nigeria Watchdog Newspaper edition of 13th November captioned “Rot in B.I.R, as chairman allegedly diverts revenue”.

In the release, captioned, “Re-setting the Records Straight”, Okoye who confirmed that he was a staff of FIIRS, when Babatunde Fowler was chairman, denied being a grade level 08 officer as at the time of his appointment. He however, did not say the exact grade level, he was on when he was appointed”.

Another demand notice sent to Nigeria Watchdog Newspaper 3 days after the Newspaper revealed alleged fraud in the agency

He said it was untrue that the monthly Internally Generated Revenue (IGR) of the state ranged between N1.5b and N1.8b when he assumed office. And that he at no time promised to raise upto N10b monthly. He also stated that, available records show that the state revenue agency has recorded the highest figure in terms of IGR, since he assumed office, without stating the range it was before his appointment and how much is collected monthly since he assumed office.

Justice Okoye also disclosed that he disengaged consultants because it is cheaper and more cost effective to provide enabling environment for staff to render the same services rendered by consultants. He was however silent on the issue of unilaterally laying off staff and deploying others to the Ministry of Finance, where they are redundant as published in the Watchdog report. He also did not say anything about the report that he came along with about eight of his colleagues at FIIRS with whom he presently runs affairs of the board; hence, it is not properly constituted as stipulated in the Imo State Revenue Administration Law No. 23 of 2019.

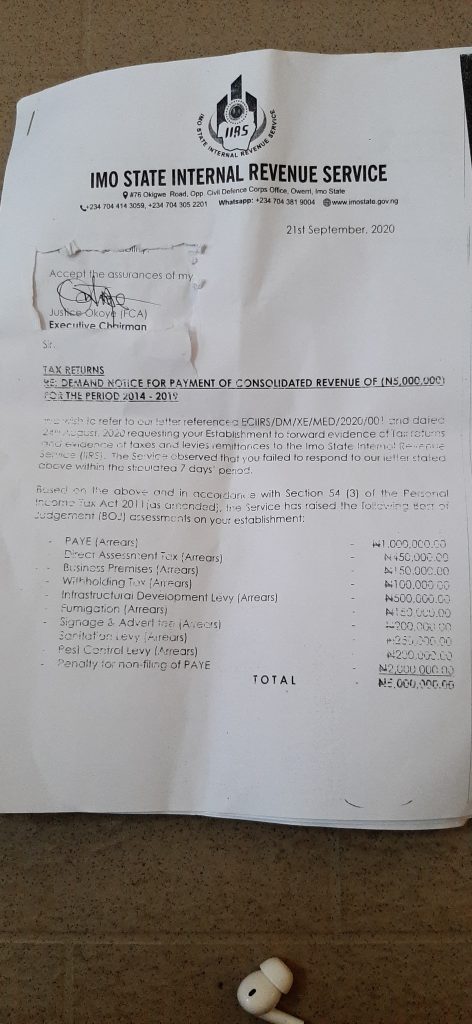

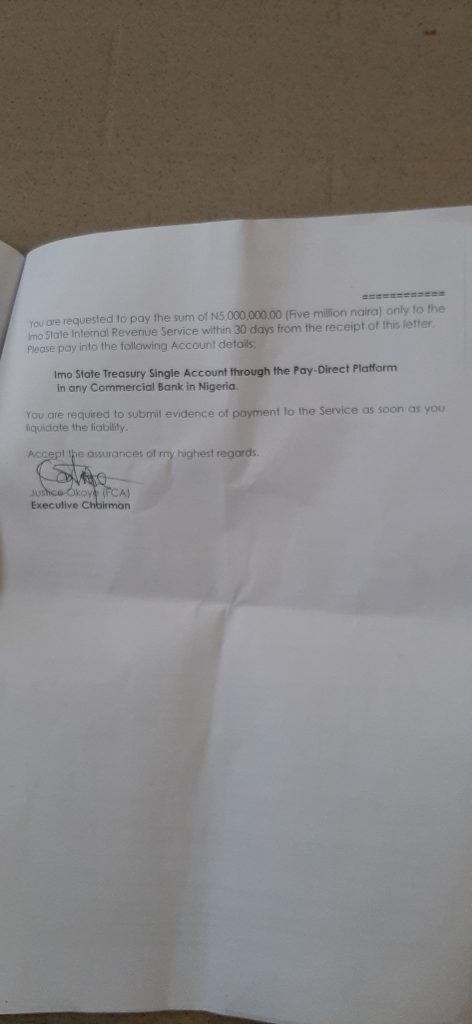

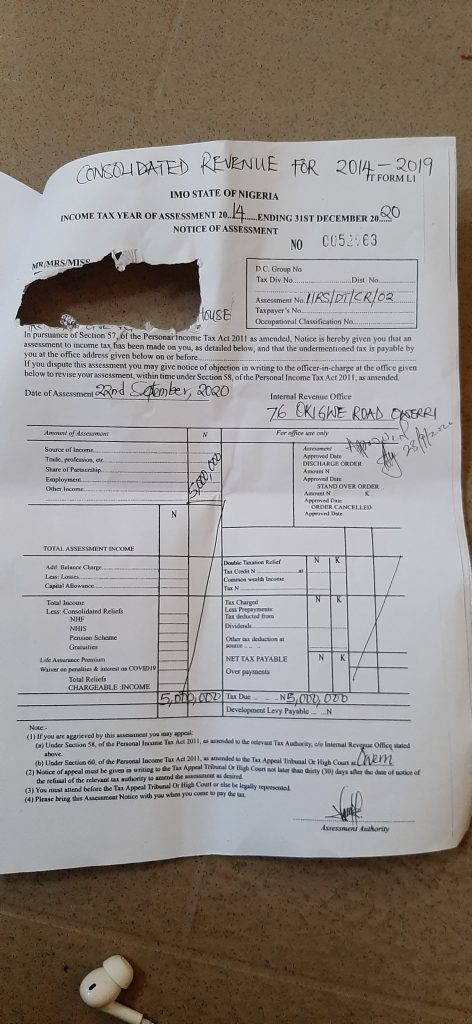

earlier demand Notice asking Nigeria Watchdog Newspaper to pay #5Million without tax assessment

The release further said, “On the issue of diversion of monies, the authors of the story are still living in the past, when such things used to happen. As at today, all tax payments in the state are made through the Paydirect or POS platforms and are paid directly into the state’s Single Treasury Account (TSA), which is beyond the control of the management team of IIRS who are not signatories to the TSA of Imo State”.

“Besides, contrary, to the Nigeria Watchdog report, no chairman of IIRS has favoured automation more than Justice Okoye whose many years of work experience and training has exposed him to the advantages of technology in revenue collection at the federal level, hence he cannot be in support of manual tax administration process. Infact, the major reason he disengaged consultants was because, whatever they were doing could be done in-house with automation. There is sufficient evidence in the state to show that his management team has deployed Point of Sales (POS) machines and reduced to the barest minimum the manual form of tax collection”.

The Board of Internal Revenue, under justice Okye’s Watch, few weeks ago served media houses in Imo(Nigeria Watchdog Newspaper inclusive) notice to pay the sum of N5m, as tax without assessment or provision of tax assessment form where necessary rebates and tax reliefs ought to be taken note of and before tax payable will be computed.

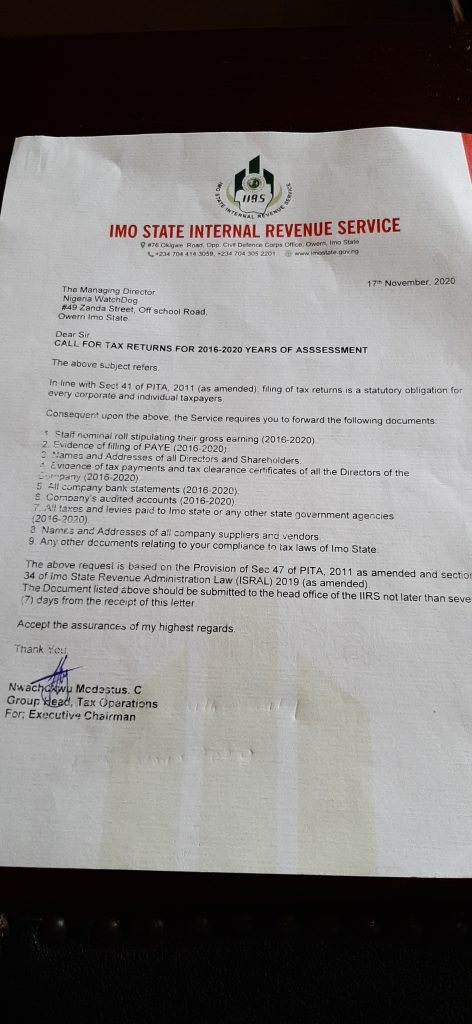

When it belatedly dawned on him that he had taken the wrong step, he ignored that and forward another letter, dated 17th November, 2020 and signed by one Nwachukwu Modestus .C. Group Head, Tax Operations requesting Nigeria Watchdog Newspaper and its Directors to provide evidence of tax payment for the past four years.As gathered,Nwachukwu is one of the 8 neophytes in tax administration but engaged by Okoye to assist him.

A group of investors who spoke to this reporter, on condition of anonymity said,“It is unfortunate that efforts being made by the State Governor to attract investors to the state are being sabotaged by the Chairman of B.I.R and his management team who are scaring away potential investors who contribute to the growth of the State’s economy with crazy and unrealistic taxes and levies without considering their start up challenges and gestation period of their businesses. This is quite unfair and counter productive”.